All About the TDS (Tax Deduction at Source)

Listen to this Article

TDS is one of the modes of collection of taxes, by which a certain percentage of amounts are deducted by a person at the time of making/crediting certain specific nature of payment to the other person and deducted amount is remitted to the Government account. It is similar to "pay as you earn" scheme also known as Withholding Tax in many other countries, one of the countries is USA. The concept of TDS envisages the principle of "pay as you earn". It facilitates sharing of responsibility of tax collection between the deductor and the tax administration. It ensures regular inflow of cash resources to the Government. It acts as a powerful instrument to prevent tax evasion as well as expands the tax net.

Every person responsible for making payment of nature covered by TDS provisions of Income Tax Act shall be responsible to deduct tax.

However in case of payments made under sec. 194A, 194C, 194H, 194I and 194J in respect of individual and HUF, only if the turnover or professional receipt exceeds sum of Rs. 40 lakh or Rs. 10 lakh respectively (the limits will be Rs.60 Lakh or Rs. 15 Lakh respectively w.e.f. 01.07.2010) in previous year, he is required to deduct tax at source.

These persons are mainly:

- Principal Officer of a company for TDS purpose including the employer in case of private employment or an employee making payment on behalf of the employer.

- DDO (Drawing & Disbursing Officer), In case of Govt. Office any officer designated as such.

- In the case of "interest on securities" other than payments made by or on behalf of the Central govt. or the State Government, it is the local authority, corporation or company, including the Principal Officer thereof.

Tax must be deducted at the time of payment in cash or cheque or credit to the payee's account whichever is earlier. Credit to payable account or suspense account is also considered to be credit to payee's account and TDS must be made at the time of such credit.

Obtain TAN

Every deductor is required to obtain a unique identification number called TAN (Tax Deduction Account Number) which is a ten digit alpha numeric number e.g.DELH90468K.

This number has to be quoted by the deductor in every correspondence related to Income Tax matters concerning TDS.

- By or on behalf of the Government : on the same day,

- By or on behalf of any other person : before the 7th of the following month.

Note: w.e.f., 01.04.2008 electronic payment of tax has to be done by all corporate assesses and all persons whose cases are auditable under section 44B.

Use challan no. 281 for depositing TDS amount.

File statements of tax deduction in the prescribed time.

The due dates for filing of TDS/TCS statement are:

15th of October for Quarter 2,

15th of January for Quarter 3 and

15th June for last Quarter however for TCS statements the due date is 30th April.

Use correct form to file TDS/TCS Returns. They are:

Form 26Q for non salaries

Form 27EQ for TCS

Form 27A/27B Control sheet for electronic TDS/TCS

It may be noted that the following persons have to compulsorily file e-TDS /e-TCS statements

- All government offices/Departments

- All companies /corporations

- All persons whose cases are auditable

- All persons whose TDS statements contain more than 50 deductees.

Dos

- Ensure that TDS return is filed with same TAN against which TDS payment has been made & TDS certificate is issued.

- Ensure that correct challan particulars including CIN and amount is mentioned.

- Correct PAN of the deductee is mentioned.

- Correct section is quoted against each deductee record.

- Correct rate is quoted against each deductee record.

- File correction statement as soon as discrepancy is noticed

- Retain the original FVU file to enable future corrections

- Make use of free of charge RPU provided through TIN-NSDL.com

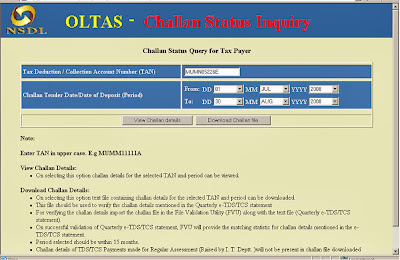

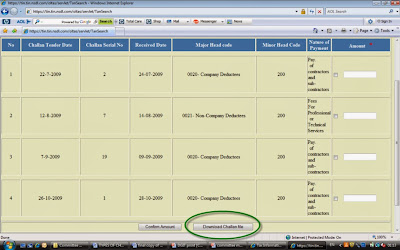

- Download details of challan from challan status enquiry (TAN based view) from TIN-NSDL.com

- Registration for TAN enables you to avail additional facilities from Tax Information System.

- Always verify status of TDS returns from Tin NSDL to ascertain the discrepancy, if any, and/or whether your TDS return stands accepted or rejected by the system.

- Don't file late returns as it affects deductee tax credit

- Don't quote incorrect TAN vis-à-vis TDS payments

Issue TDS certificates as per existing procedure and within the time prescribed as stated below:

- The certificate should be issued within one month from the end of the month in which the income is credited however for credit entries made on 31st March, due date is 7th June, except in the case of salary where the certificate has to be issued by 30th of April of the following financial year in which the income was credited.

Dos and Dont's for Depositing Tax

Dos

- Use challan type 281 for deposit of TDS/TCS amount.

- Deductor should quote correct TAN, full name, address and current A.Y. on each challan.

- Deductor should use separate challan for different nature of payments quoting correct nature of payment code and also for different type of deductee.

- Ensure that the bank has mentioned CIN (Challan Identification Number) on the counter foil. Verify CIN details uploaded by the bank to TIN i.e., 5 digit challan serial no., BSR code of 7 digit and date.

- Insist on computerized receipts from the bank

- E- payment of TDS is recommended.

- Don't use incorrect type of challan

- Don't quote wrong TAN/PAN or use PAN in place of TAN or vice versa.

- Don't use a single challan for corporate and non-corporate deductees.

- If one has multiple TANs, use one TAN only consistently and surrender the others.

- Don't use preprinted challans without verifying TAN/PAN.

- Each branch/division of an entity will have a separate TAN if it is filing separate TDS/TCS returns. However, there will be only one PAN for a legal entity.

- Do not make mistake in indicating the Assessment Year in the challan

Through the TAN Based View details of all challans deposited in the banks for a given TAN during a specified period can be viewed.

Category : Income Tax | Comments : 0 | Hits : 1197

Selling property in India? You're probably worried about the capital gains tax bill that comes with it. Here's some good news—both the old and new tax regimes offer you ways to save big on taxes if you reinvest your sale money in a residential house. Let me break down Section 54F (from the old Income Tax Act 1961) and Section 86 (from the new Income Tax Bill 2025) in simple words, so you can understand which rules apply to you and how to make the most of them. What's the Big...

Income Tax Alert - Here Are 5 High-Value Transactions That May Come Under Scrutiny. Large Cash Deposits: Any cash deposit exceeding Rs 10 lakh in a financial year across savings accounts draws the attention of the income tax department. Even if deposits are spread across multiple accounts, the cumulative amount beyond the threshold triggers scrutiny. Fixed Deposits: Surpassing the Rs 10-lakh limit in fixed deposits within a financial year prompts inquiries regarding the source of f...

Delhi Court Sentences Woman to 6 months Jail for not filing the return of income (ITR) discussed. Accordingly, the accused is held guilty of not filing the return of income for the assessment year 2014-15 under Section 276CC of The Act. Accordingly, the accused is convicted for an offence punishable under Section 276CC of the Act," the court said in the judgement. "The convict is awarded a sentence of simple imprisonment for six months with a fine of Rs 5,000 and in default to unde...

Payments to MSME vendors

Corporates, Non-corporates or government department all are procuring major part of services or goods from the MSMEs. There are provision under the Micro, Small, and Medium Enterprises Development (MSMED) Act, to ensure that businesses make payments to MSMEs within a specified time frame, and failure to which can impact the deduction claims for such payments. To facilitate timely payments to micro, small, and medium enterprises (MSMEs) and address the challenges faced by these businesses in rec...

In the Income tax act, the words “Turnover”, “Gross receipts” and Sales are used at many places. In the common business parlance, the terms sales and turnover are used interchangeably. However, as per Income Tax law, guidelines are available on the question of what constitutes turnover. Understanding the concepts of these words is necessary for the purpose of the tax audit. An audit is mandatory for corporate assessees, irrespective of the amount of turnover. In ...

Comments