Rs. 1,72,129 Cr gross GST revenue collected during January 2024

Listen to this Article

The gross GST revenue collected in the month of January, 2024 (till 05:00 PM of 31.01.2024) is Rs.1,72,129 crore, which shows a 10.4% Year-o-Year (Y-oY) growth over the revenue of Rs.155,922 crore collected in January 2023 (till 05:00 PM on 31.01.2023).

Notably, this is the second highest monthly collection ever and marks the third month in this financial year with collection of Rs.1.70 lakh crore or more. The government has settled Rs.43,552 crore to CGST and Rs.37,257 crore to SGST from the IGST collection.

During the April 2023-January 2024 period, cumulative gross GST collection witnessed 11.6% y-o-y growth (till 05:00 PM of 31.01.2024), reaching Rs.16.69 lakh crore, as against Rs.14.96 lakh crore collected in the same period of the previous year (April 2022-Jannuary 2023).

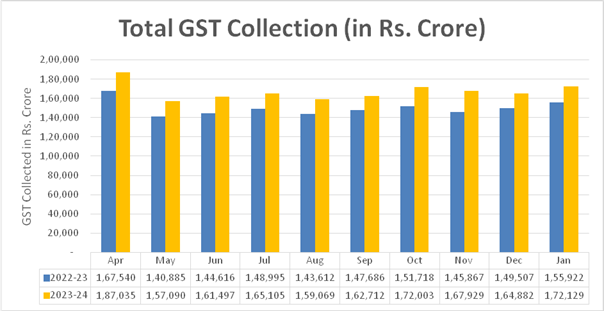

The chart below shows trends in monthly gross GST revenues during the current year. The data is as of 05:00 PM today (i.e. 31.01.2024). Final collection for the month would be higher.

Chart: Trends in GST Collection

****

NB/VM/KMN

Category : GST | Comments : 0 | Hits : 498

Comments