Indirect tax collection up 36% in first seven months

Listen to this Article

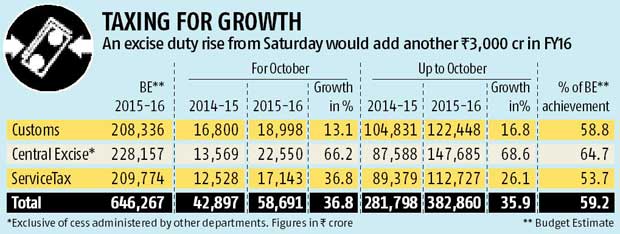

Excise duty rises on oil, along with a couple of other measures, pushed up indirect tax collection by 36.8 per cent to Rs 58,691 crore in October and 35.9 per cent to Rs 3.82 lakh crore in the first seven months (April to October) of the current financial year, official data showed on Monday.

However, for gauging industrial growth, the impact of additional measures have to be taken out. In that case, these collections were up only 13.5 per cent in April-October 2015-16, finance minister Arun Jaitley had earlier said.

Beside excise duty rises on petroleum, additional steps include withdrawal of concessions here for automobiles and capital goods, and an increase in the service tax rate in June to 14 per cent from the earlier 12.66 per cent. The effect of the additional measures was evident, as the bulk of the growth in indirect taxes came from excise duty collection, which grew 68.6 per cent to Rs 1.47 lakh crore till October.

For October alone, the duty delivered Rs 22,550 crore to the exchequer, rising 66.2 per cent.

The indirect tax collections in these first seven months — service tax, excise duty and customs — were 60 per cent of the entire Budget Estimate for the year.

Customs revenue grew 16.8 per cent to Rs 1.22 lakh crore during the seven months. Service tax revenue expanded 26.1 per cent to Rs 1.12 lakh crore in the period. It could rise more after November 15, as a 0.5 per cent Swachh Bharat tax would yield more to the kitty. Also, an excise duty rise from Saturday would add another Rs 3,000 crore in the remaining period of FY16.

The finance ministry is expecting a five to seven per cent shortfall, about Rs 50,000 crore, in collection for the year on account of lower than estimated revenue from direct taxes but expects robust indirect tax collection to compensate.

Industrial growth was 4.1 per cent in June and 6.4 per cent in August. The September figures would be issued later this week.

The government remains confident of over 7.5 per cent economic growth for 2015-16, though it had fallen to seven per cent in the first quarter of 2015-16, against 7.5 per cent in the previous quarter. (Business Standard)

Category : General | Comments : 0 | Hits : 318

Retirement fund body EPFO has said it will no longer use Aadhaar as a valid document for proof of date of birth. In an official circular on January 16, the Employees' Provident Fund Organisation (EPFO) said the decision to remove Aadhaar was taken following a directive from the Unique Identification Authority of India (UIDAI). As per the circular, Aadhaar is also being removed from the list of documents for correction in date of birth.

A five-day-long Special Parliament Session will be held from Monday. A Parliamentary Bulletin said, that on the first day a discussion on the Parliamentary Journey of 75 years starting from Samvidhan Sabha - Achievements, Experiences, Memories, and Learnings will be held in Lok Sabha. The Government has listed Bill on the appointment of the Chief Election Commissioner, and other election commissioners in the upcoming Parliament Session. Apart from this The Advocates (Amendment) Bill, Th...

Artificial intelligence can substitute neither the human intelligence nor the humane element in the adjudicatory process, the Delhi high court has held and said ChatGPT can't be the basis of adjudication of legal or factual issues in a court of law. Justice Prathiba M Singh stated that the accuracy and reliability of AI generated data is still in the grey area and at best, such a tool can be utilised for a preliminary understanding or for preliminary research. The court's observati...

Domain + Website + Hosting + 2 email ids @ Just Rs.3100/- with 30 days Money Back Guarantee. CASANSAAR offers a Golden opportunity for Professionals, where they could create their own stunning website with multiple designs and templates to choose. It will be completely your own space, which is going to be a Dynamic Website and could be edited as per your wish. Now Get 2 Email ID's with Your Own Websi...

The Delhi High Court Monday sought the Centre’s stand in a plea against a notification where chartered accountants, company secretaries and cost accountants have been included among “reporting entities” under the Prevention of Money Laundering Act (PMLA) A division bench of Chief Justice Satish Chandra Sharma and Justice Sanjeev Narula granted time to Additional Solicitor General Chetan Sharma, who appeared for the Centre, to “seek instructions” and listed the ma...

Comments