11 lakh PAN have been deactivated: Here's how to check if your PAN is active or not

Listen to this Article

0:00

0:00

Recently, Minister of State for Finance Santosh Kumar Gangwar in a written reply informed the Rajya Sabha that as on July 27, 11,44,211 PANs have been identified and deleted or de-activated in cases where multiple PANs were found allotted to one person.

A person cannot hold more than one PAN. A penalty of Rs. 10,000 is liable to be imposed under section 272B of the Income-tax Act, 1961 for having more than one PAN.

If a person has been allotted more than one PAN then he should immediately surrender the additional PAN card(s).

To check whether one's PAN is active or in an inactive stage, here's the process.

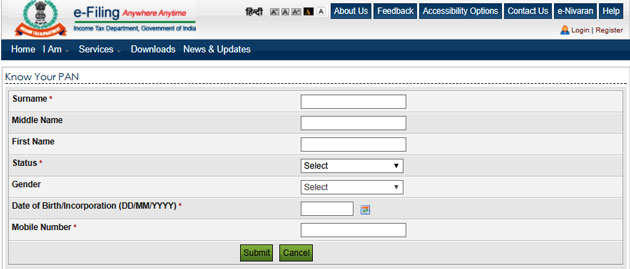

* Click here or access https://incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourPanLinkGS.html

* Enter surname, name, and date of birth etc along with mobile number

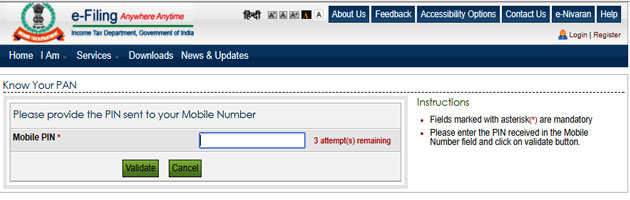

* Receive the OTP on mobile

* Enter OTP

* Result page shows PAN and jurisdiction officer address and active/inactive status

Step 1 - After clicking on the link above

A person cannot hold more than one PAN. A penalty of Rs. 10,000 is liable to be imposed under section 272B of the Income-tax Act, 1961 for having more than one PAN.

If a person has been allotted more than one PAN then he should immediately surrender the additional PAN card(s).

To check whether one's PAN is active or in an inactive stage, here's the process.

* Click here or access https://incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourPanLinkGS.html

* Enter surname, name, and date of birth etc along with mobile number

* Receive the OTP on mobile

* Enter OTP

* Result page shows PAN and jurisdiction officer address and active/inactive status

Step 1 - After clicking on the link above

Step 2 - Enter OTP

Result Page - Know your PAN and PAN status

Just in case, you have forgotten the PAN or want to locate the jurisdiction officer address, the link above may help you in locating them.

The facility to delete or de-activate the PAN is available with the Assessing Officer through application software.

During 2004 to 2007 also, an exercise for de-duplication of PAN was conducted in the tax department to identify probable duplicate PANs. #casansaar (Source - Economic Times)

Category : PAN | Comments : 0 | Hits : 2054

Comments