Government draws up checklists for GST Audits

Listen to this Article

In the past week, the government has reached out to tax commissioners on the audit process, highlighting the risk areas. Beginning next week, therefore, officials could visit companies to assess whether the transition from the multiple to the single producer levy from July 1 stuck to the rule book.

Their mode of inspection will also be very different from the traditional script. "They would focus on credit transfer or transition from the old tax regime to GST. The government already has the requisite sets of data in place for this," a tax official told ET on the condition of anonymity.

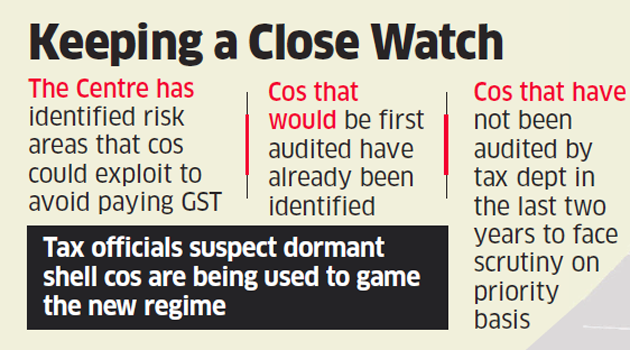

The government has shared sector-wise "risk factors" companies might exploit to avoid paying GST. According to the tax official quoted above, categorisation or risk evaluation for these audits has been created by using Big Data analytics.

The government has used statistics of the last two financial years to create the audit checklist.

In the internal government note shared with middle-rung tax officials, they have also been told to cause the “least inconvenience” to auditees and to even educate the taxpayers, especially small and medium enterprises (SMEs).

Industry experts, however, pointed out that a granular scrutiny could mean additional tax-related effort at many companies, as the GST audits would also take earlier taxes into account while evaluating the transition.

‘Extra book-keeping effort’

“The decision to focus on risk-based parameters in determining the audit plan is good. However, since the audits to be undertaken now would focus on earlier legislation such as excise and service tax, taxpayers will grapple with both the earlier legislation and the new legislation (GST) simultaneously,” said MS Mani, partner, GST, Deloitte India. “It would significantly increase the focus and time taken to attend to tax matters.”

A list of auditees, made up of large, medium, and small-scale companies across the country, was also shared with the tax commissioners. “Most of the companies have manipulated the system while transitioning credits from excise and service tax to GST. This is what would be the focus of the tax audits initially,” a senior tax official told ET.

Tax officials have been asked to first examine a specific list of companies. This was disclosed in an official communication by the director general of audit, central taxes, on July 12, with several mid-level tax officials being informed this week.

Big Data analytics are being used by the tax departments since 2016. The tool is deployed to find outliers in any industry, and the gap from industry based average taxes is used to determine targets for further scrutiny.

“The government would have comparables. Say, if 10 consumer goods companies of a particular size pay Rs 50 crore in taxes, it is unlikely that one company, of the same revenue size, would pay Rs 1 crore. Data analytics could easily point out such anomalies, and the lens would then be on such companies,” a person in the know said.#casansaar ( Source - Economic Times)

Category : GST | Comments : 0 | Hits : 1590

TEST

Dear Taxpayers, 1. GSTN is pleased to inform that an enhanced version of the GST portal would be launched on 3rd May 2024. The effort is to improve user experience and ensure that the information you need is accessible and easy to navigate. 2. Key Enhancements Include (PDF with screenshots attached): i. News and Updates Section: We have introduced a dedicated tab for all news and updates. This section now includes a bet...

The Supreme Court on Friday issued notices to the central government, the Central Board of Indirect Taxes and Customs (CBIC), the Goods and Services (GST) Council and the National Anti-Profiteering Authority (its functions have been taken over by the Competition Commission of India) on a petition challenging a Delhi High Court verdict, upholding the constitutional validity of anti-profiteering provisions filed by a real estate company. The petition, filed by Swati Realty, says the high court ...

The delectable Malabar Parota will taste even better with the Kerala High Court ruling that the popular flatbread will attract GST at 5 per cent and not 18 per cent. With this the court has turned down order by the State’s Authority of Advance Ruling (AAR) and Appellate Authority for Advance Ruling (AAAR). Disposing a petition by Kochi-based Modern Food Enterprises, a single judge bench of Justice Dinesh Kumar Singh said if key inputs (cereals, flour, starch, etc) and preparations are s...

A businessman from Delhi was taken into custody by the Noida police for his alleged involvement in a massive Rs 15,000 crore GST fraud that was exposed last year, TOI reported. Tushar Gupta, aged 39 and residing in Tilak Nagar, was arrested as the 33rd suspect in this case. The police revealed that Gupta had exploited input tax credit (ITC) using 35 fake companies, resulting in a loss of Rs 24 crore to the exchequer over the past two years. He was reportedly part of a syndicate that utiliz...

Comments